Dear Mr. Zuckerberg,

With the announcement of Libra you have decided to enter a new market, a growing and healthy digital payments space, who could blame you! Most would agree it aligns well with your ever growing Facebook, Instagram, WhatsApp and marketplace services. But while the approach appears to be well thought out (even going to the extent to be proactive about push back from regulatory entities) I think you should take look at how Amazon has gone about entering into a new market.

As we all know Amazon started off selling books and grew into the behemoth they are today, but by no means is it a one trick pony. In Q3 this year Amazon Web Services (AWS) generated 9 Billion…..yes with a B! So how did an online book store become the leading provider in the cloud market? For the sake of time we will be concise, but for those who want to read more here you go. The initial infrastructure they built was based off the demand of their growing marketplace allowing them to become experts and innovators in the space. Simple as that. Once they felt it could be commercialized they executed accordingly and turned what was once a cost center into a profit center. They appear to now be doing this with logistics and healthcare so watch out UPS and CVS!

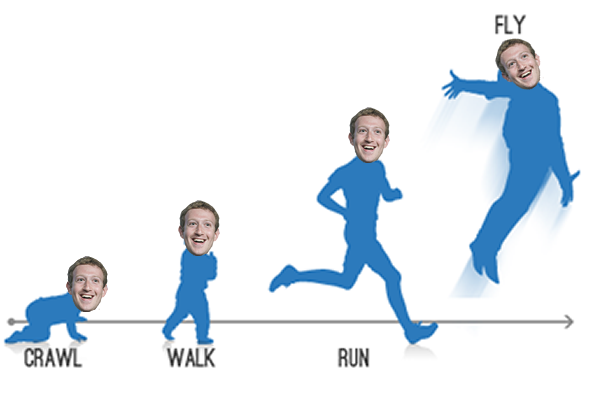

Now Zuckerberg – with 35,000 employees and thousands of clients you have an incredible opportunity to launch a private digital token similar to your proposed Libra. Establish a token which represents U.S. dollars held by Facebook and digitize it. Now have have your employees use it at your cafes on campus, transfer payments with clients, just start using it and gathering data. We have even seen J.P. Morgan launch JPM Coin to help with the instantaneous transferring of payments between them and some of their clients.

Regulators currently have a laundry list of concerns with Libra; how it works, privacy issues, security risks and hundreds more. Having real world examples of specific processes put in place for know your customer (KYC) and anti-money laundering (AML), combined with what would be a plethora of data would do wonders to support your entrance into a new and controversial digital payments space. Now I understand not every situation can be replicated for a public blockchain but at a minimum position yourself to show what this end product would look like so regulators can have a better understanding of at least some scenarios. The big ticket items you need to show clarity around are KYC, AML, security and the ability to separate financial and behavioral data.

There is no question to whether you have the resources or knowledge on how to get this up and running, so why haven’t you already? Gathering the information you need to help support your launch of Libra seems like a no brainer. So go kick the tires with a private blockchain and give Bezos a call if you need some guidance along the way.

Sincerely,

Dane