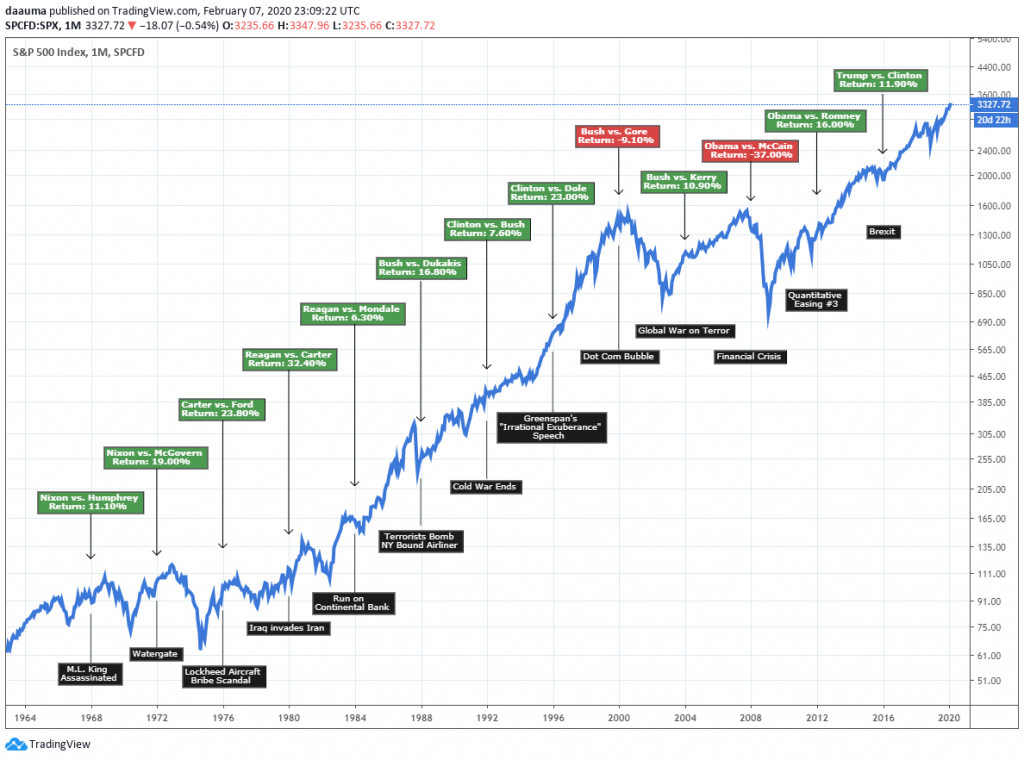

Every Presidential Election year we all ponder the same question…..how is this going to impact the markets? As you can guess there is no clear answer and it is important to remember past performance is not indicative of future results. That being said I still wanted to see the data for myself so I gathered and plotted it out on the S&P 500 over the course of the last 13 elections.

The average return over each of the past 13 election years has been 10.21%. At first glance, it is easy to see there have only been two election years that ended up seeing negative returns (Dot Com Bubble and Financial Crisis). What is not so evident is the volatility within those election years. As we all know investors do not like uncertainty and what the data shows is in years where a new President is going to be elected (incumbent already served their 2 terms) the markets tend to be more volatile and bearish than years when an incumbent is running.

Why is this? Likely because of the increased “unknowns”. Two new candidates pushing forward with new ideas, new policies and new leadership does not put investors at ease. The good news is this upcoming election does have an incumbent with clear policies and an established vision. Nevertheless we can all feel how divisive the current political landscape is which puts us in a situation where we could see increased volatility as the Democratic party selects their candidate and we get closer to the Presidential debates.

To sum it up, there is no way to predict what will happen during this election year but it is important to understand what sectors and industries your portfolio is exposed to. Certain sectors and industries will likely get hit harder based off the views, talking points and proposed policies each candidate holds. Discussing these at future debates, rallies and campaign events may create both buying and selling opportunities along the way in Health Care, Information Technology, Communication Services and Financials as they try to convince the voters on what is best for America. What sectors/industries do you think will get hit the hardest? Share below!