As the S&P500 took a 3.35% dive today I figured I would publish some of the data we have been kicking around trying to decipher true impact of the current Coronavirus epidemic.

Let’s start by comparing the economic data of a 2003 China vs a 2019 China. It is important to note SARS occurred back in 2003, after a bear market, in which the markets saw a V-shaped recovery. SARS was estimated to do $33 Billion in damage to the global economy.

GROWTH

- Since 2003 China has grown from the world’s 6th largest economy to the 2nd largest

- China has been a major growth driver worldwide, IMF estimates China accounted for 39% of global economic expansion in 2019.

What does this tell us? It is easy to see how much bigger of an impact China’s economy has on both global GDP and global growth. Seeing their share of global GDP quadruple since 2003 helps us realize by their sheer size this will likely be a bigger drain on GDP than SARS.

IMPORT / EXPORT

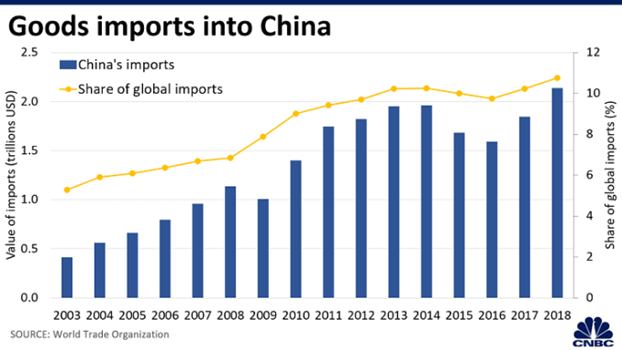

Imports: China is currently the largest importer of commodities. Mainly oil, iron ore, soybeans and electronic parts. Demand for these products as on of the largest manufacturing countries in the world will likely cause excess supply and a fall in price.

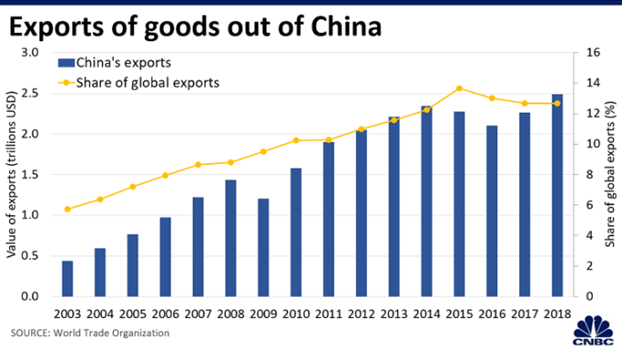

Exports: In 2019 exports were responsible for 20 trillion of our global GDP which is roughly 23% of the Global GDP. With China accounting for over 12% of the world’s exports if this virus continues to hinder the world’s ability to export these goods we may see a longer lasting supply shock than we initially thought.

BREAKING DOWN CHINESE ECONOMY

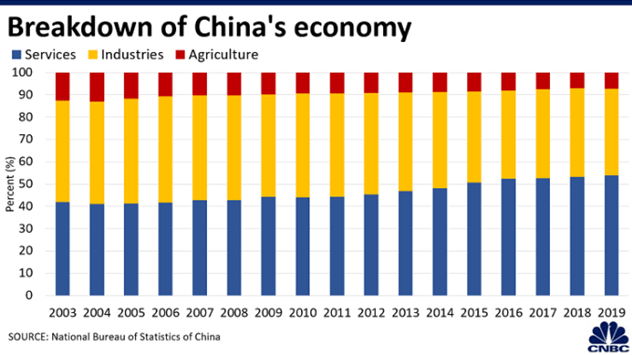

- Services and the consumption make up a much larger part of the Chinese economy now, going from 40% in 2003 to 52% in 2019.

- Service Industry was hit with $144B loss in one week from the Coronavirus (Source). * Remember SARS was estimated to do $33B in damage to global economy in total. Not adjusting for inflation that means there was 330% more damage just to the Chinese service industry in on week.

With the growing middle class in China we have seen an increase in the consumption of the service industry (legal, financial, telecom, construction, computing, etc). In the event people stay home and/or “locked down” longer than expected the services industries will take a hit and impact both China and global GDP. While it is more opinion based than fact based most service industries, especially travel and tourism, often are not made up at a later time compared to buying hard goods (iPhone, AirPods, Gaming PCs, etc).

CHINESE BANKING SYSTEM

- Even before Coronavirus occurred Chinese corporate debt has been seen as a potential threat. In Dec. 2019 Moody’s called Chinese Corporate Debt the biggest threat to the global economy. Source. While being more of a scare tactic some are comparing it to banks using high leverage with risky assets (similar to ’07 in US)

- Due to small and medium sized businesses being shut down for extended periods of times policy makers directed regional lenders to tolerate a higher threshold for bad loans to keep small/medium sized enterprises (SME) from collapsing during economic standstill. 85% of these SMEs would not stay afloat within three months without financial injections of some sort. Source

What we are continuing to look for here is a better understanding how quick these SME can get up and running without taking on too many risky loans from lenders. We will be watching this closely.

OTHER CONCERNS

- Employees taking the brunt of it with furloughs, having to use paid vacation and dealing with unpaid leave. Source

- In the event it makes its way to a country who does not have the capabilities and/or resources to mitigate and contain (technology, medical treatment, etc). “Only as strong as the weakest country”

- Estimated 750M in some form of “lock down”. Source. May create a bigger impact than initially thought on the services revenue / consumption from China. Example being one complex in Beijing tests positive for a case of Coronavirus they all get locked down other than incoming E-Commerce deliveries.

- Many countries such as Japan & Vietnam heavily rely on Chinese supply chain to import materials and parts from China to make their own products to export hurting their GDP.

SUMMARY

There are a million different permutations on how this could play out so we will continue to monitor and align our portfolio strategies as the data comes in. Leveraging the data points mentioned above as well as real time Coronavirus data (see some of the available data in the links below).