With Halloween right around the corner there is no better topic to discuss than the Zombification of the U.S. Financial Markets. So far 2020 has proved to empower even the most decrepit, decaying and hungry (for debt) Zombies.

Let’s first nail down what a Zombie is. In it’s simplest form – a Zombie is a firm who is unable to cover it’s debt servicing costs from current profits – meaning they must borrow money to pay interest on existing debts. Most, key word being most, Zombies are over-leveraged companies with a business model that is unsustainable. To be clear – they must raise NEW money from NEW creditors to pay EXISTING creditors.

How Does a Zombie Come To Exist?

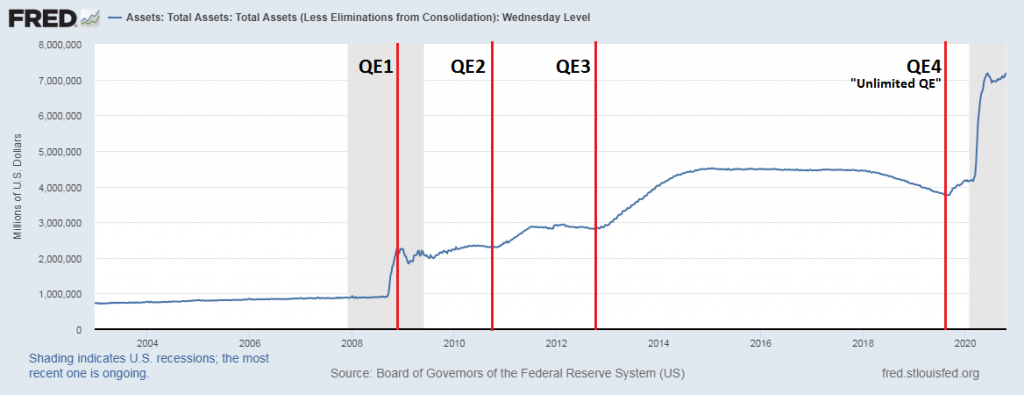

Typically Zombie companies are born out of years of loose monetary policy along with quantitative easing (QE). Recent actions from the Federal Reserve have contributed to their growth as more companies increase leverage while taking advantage of the low interest rates. On March 23rd (the lowest print on the S&P500 for the year) the Fed announced that it would start buying corporate bonds and bond exchange traded funds (ETFs) which set off a huge rally in the bond market, including the junk-bond market. This announcement triggered companies to issue new debt and investors to chase/purchase junk-debt at record levels. This not only created new Zombies but kept existing zombies walking.

Are All Zombies Bad?

The short answer, No. The more nuanced answer is it depends. But for the sake of simplicity below I’ve quickly outlined a good vs bad zombie.

- Good Zombie: Young companies that are ramping up and investing in growth. *Typically “Good Zombies” will want to finance through equity and not debt thus making “Good Zombies” hard to find.

- Bad Zombie: Over-leveraged, around for years, has thousands of employees, billions in assets and liabilities and a business model where their revenues do not cover all of their operating expenses + interest payments. *Often marked by junk debt rating

A Look Back In Time

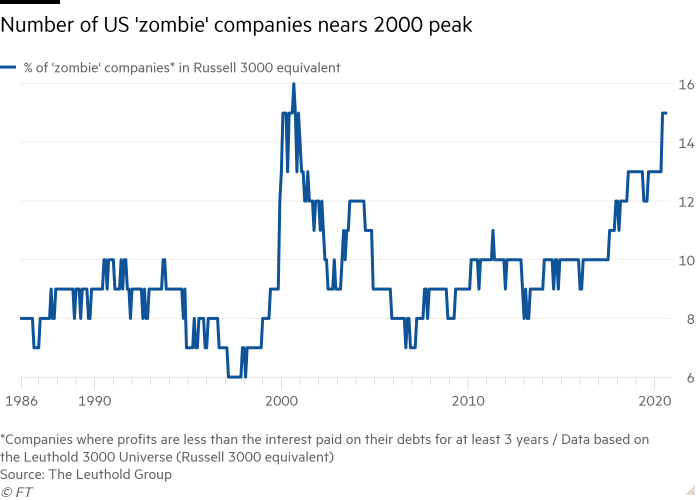

Now that we have gained more clarity around Zombie companies lets look back and see how prevalent they have been in the last three or so decades. As you can see below we are reaching Zombie territories not seen since the tech bubble. Why have we ramped up over the past 10 years?

Well as we have covered already, we know loose monetary policy and QE increases lead to an increase in Zombie companies. So let’s look at the timing of QE over the past 15 years. Using the chart below we can see a correlation of increased QE and an increase in the number of Zombie companies. This combined with loose monetary policy has driven us to almost 16% of publicly traded companies being identified as Zombies.

So What Does This Mean For Markets?

In the near term both companies and investors appear to be happy. The Federal Reserve (Fed) intervened to increase confidence and help unfreeze the credit markets and it worked. A company like Carnival Cruise Lines was ecstatic to be able issue billions of dollars in Junk bonds. And after doing so investors were lined up even more excited to buy them!

Win-Win right? Well with each of the big three indexes nearing their all time highs it is hard to say no. But the reality is these Zombie companies can clogg up the economy, productivity and future growth. If the Fed continues to bail these companies out they only make the problem worse. The ones who lever up and take the most risk should be left to restructure in bankruptcy court, shed their debts and allow the investors to eat the losses. This allows these companies to be smaller and nimbler and re-invest in their future. This is capitalism and this self-cleansing process is needed. Those who take the most risk should be allowed to take the losses. This gives them as well as future investors a reminder to be prudent. This entire process allows capital to be allocated where there is the most productivity, while keeping in mind risk.

Now with that being said I must put myself in the Fed’s shoes. We had an unexpected Pandemic which without intervention could have led us into a deep depression. By intervening they have prevented companies from going bankrupt while at the same time keeping employees working. They have successfully helped bridge many companies through this difficult time period and time will tell if these companies who are on “liquidity respirators” will return to health or not. Let’s hope these Zombies can shed debt and get back on track before big bad creditors come knocking.

What do you think? Did the Fed make the right move? Let me know in the comments below.