Not long after COVID landed in the U.S. our government has doled out an unprecedented amount of pandemic relief directly to consumers. One-time stimulus payments, enhanced unemployment benefits, mortgage forbearance, student loan suspensions and other programs have enabled consumers to come out of this global recession with extremely strong balance sheets. This led us to see record retail sales numbers emerge through 2020 and the first half of 2021. But how will the consumer spend moving forward? Economists estimate U.S. households currently have 2.5tn of excess cash (or cash equivalents) on hand. Will they continue to rapidly spend as most predict? Or will we see a subsequent crash after the last 12-month “sugar high”? Let’s explore.

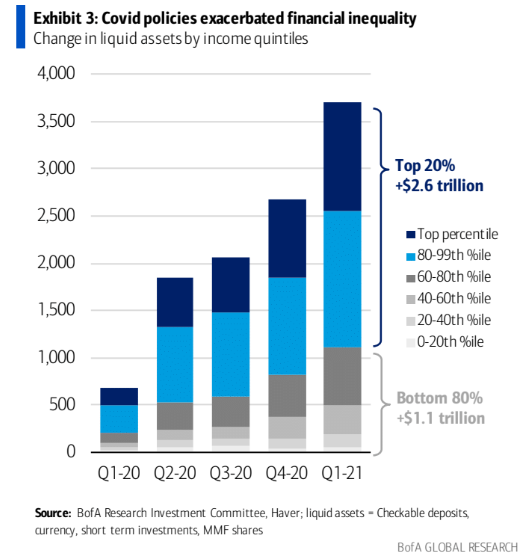

The first thing we need to look at is who has all of this 2.5tn? As you can see from the graph below, 70% of the cash is held by the wealthiest 20% of households. This cohort tends to spend in the real economy at a much lower rate than lower-income working families. In fact, one Boston Fed Study found that in normal circumstances the bottom 20% of households were likely to spend $0.97 of every dollar earned, while the top 20% spent just $0.48 of every extra dollar. That being said, a glut of cash on the balance sheet of already wealthy households is unlikely to help keep us at sugar-high sustained spending levels.

So what about lower-income working families? We know they have been a large beneficiary of enhanced unemployment benefits, with the majority earning more by staying home and not working. This cohort has a much higher propensity to spend but with the looming deadline of unemployment benefits, many are saving as much as they can before going back to work to earn even less than they are making now. So now that we know where the cash sits and who is spending it let’s take a look at what they may spend it on in the coming months.

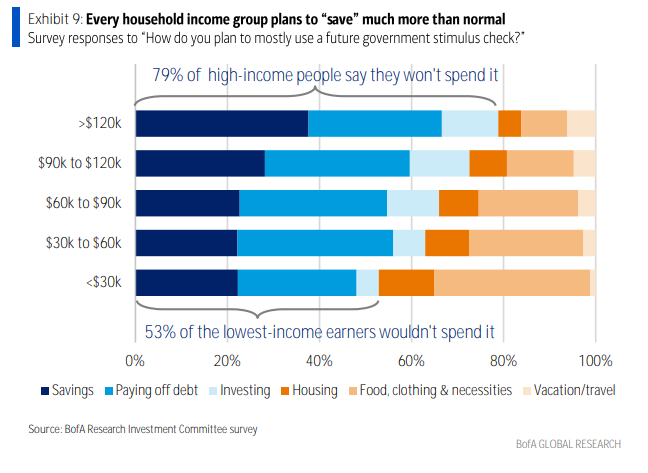

At the end of February Bank of America surveyed more than 3,000 people about how they would spend their stimulus in 2021. You can see the results below but across every household income group 30% said they would pay off debts, 25% said they would save it and 9% said they would invest it. So for every $1 in stimulus across all income groups roughly $0.64 will go towards Paying Debts / Savings / Investing.

Along with consumers intending to save more, existing government programs will be rolling off over the course of the next 6-12 months. The Pandemic Unemployment Benefits will end come the middle of September. This removes the additional $300 in federal stimulus payment along with any emergency unemployment compensation for gig workers. We will see the end of the Mortgage Forbearance which requires homeowners to begin servicing their debts (taking away from consumption). We will see eviction moratoriums lifted which will put pressure on renters to either pay up or move to a new home and begin paying. Last but not least at the end of September student loans will no longer be suspended and payments must be made. You can begin to see how the consumer may have to start allocating their cash away from their current spending habits and back to a pre-sugar-high world.

In summary: Like a kid after Halloween, Americans have received trillions in both direct stimulus payments and indirect programs designed to strengthen their balance sheet giving them quite the sugar high. They are sitting on piles of cash. Some of it has been spent, a lot of it has been saved and a large portion has been used to pay down burdensome debt. We are now at the inflection point where the economy has nearly fully re-opened and we will see how big this pent-up demand really is. Will consumption revert to trend, coming down from the sugar high, as households direct more cash to savings (cash, debt payments, financial assets)? Or will spending continue to boom? Currently, the data is pointing towards consumer spending moderating going into the second half of 2021 but we will be closely monitoring spending habits to better understand the outlook of secular growth vs the re-opening.