IN REVIEW: 2023

2023 will be remembered as a year that defied expectations. Expectations for inflation, for growth, and for markets. Indeed, equity markets staged a dramatic comeback in 2023 following 2022’s losses, due in no small part to widely negative expectations.

Inflation came down much more rapidly than was anticipated. Core PCE, the Fed’s preferred inflation gauge, is already back to the Fed’s 2% target on a 6 month annualized basis. And there’s more disinflation in the pipeline, particularly as the lagged input of housing costs continue to feed into inflation readings.

Growth, meanwhile, surprised to the upside. Forecasts at the beginning of 2023 called for GDP growth of roughly 1.5% for the year, with a 2 in 3 chance of the US entering a recession. In the end, GDP appears to have done almost twice that on the year. Continued strength of the consumer, rapidly falling price pressures on companies (aside from wages), and a secular boom in A.I. technology all helped buoy growth for the year.

Equity markets, of course, soared. Coming into 2023 with a backdrop of lowered valuations and pessimistic outlooks, the favorable surprises on growth and inflation were the perfect fuel for the markets to move higher. This came despite the fact that 2023 S&P earnings estimates fell for the entire year, appearing to close with less than 1% growth for the year. Bond performance, meanwhile, was volatile but ended mostly flat in 2023. Continued upside surprises on growth created uncertainty about the path of interest rates for much of the year, causing difficulty for bond investors.

WHAT’S AHEAD: 2024

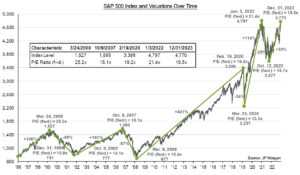

While 2023 was all about surpassing low expectations, we head into 2024 instead facing the obstacle of loftier expectations. Following some particularly dovish language from the Fed late last year, the markets are now pricing in 7 (yes, 7!) rate cuts for 2024. Inflation is expected to remain on its downward trajectory, reaching the Fed’s 2% target on a year-over-year basis as soon as mid-year. While GDP growth estimates remain modest at around 1-2%, S&P earnings estimates are for growth of about 12%. And forward P/E estimates, assuming the 12% growth in earnings is achievable, sit elevated at just over 19x, decently above their long-term average.

In essence, consensus seems to be placing higher and higher probabilities on a soft landing: we return to a slow growth, low inflation environment that allows persistently elevated valuations, all while avoiding a recession. While not out of the question, this would not be consistent with the end of the majority of Fed tightening cycles, which tend to end in recession. Notably, of course, the Fed’s policy tools seem to have had a more muted impact this time around, particularly on consumers, who are relatively less leveraged to variable interest rates than in past cycles. Indeed, paired with robust balance sheets from the pandemic fiscal stimulus and wage gains, the consumer has firmly kept the economy afloat.

Inflation, meanwhile, has appeared to be somewhat more transitory after all (team transitory is not dead yet). As unique supply and demand shocks have abated, inflation has swiftly moved down. Prices are still high of course (disinflation is not deflation), but the progress of inflation coming down has been consistent and fairly rapid.

Current Conditions

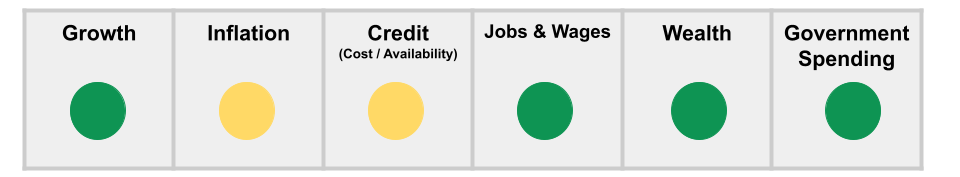

Looking at the economy today, it is hard to be pessimistic in the short term with growth holding relatively strong and inflation trending back to its 2% target. The result of this shows up in the real economy where current conditions are quite positive.

Three Paths in 2024

As investors, we see the world as a range of possible outcomes. While a perfect soft landing may be in the cards, we envision several ways that 2024 could play out across inflation, growth, and markets. We present them here, along with their estimated probabilities and implications for asset class performance.

We have our Best Case – the ideal outcome; our Base Case – the most likely outcome; and our Worst Case – the least favorable outcome.

2024 Scenarios

OTHER UNIQUE CONSIDERATIONS

Beyond the above scenarios, there are several more idiosyncratic things to consider in 2024: market performance during an election year, current investor sentiment and positioning, and budding competition for equities in the bond and alternative space.

Reasons to be Bullish

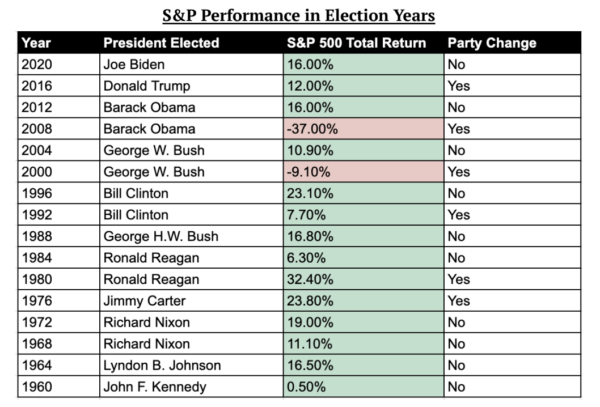

Let’s not forget that 2024 is an election year. Notwithstanding all of the scenarios outlined above, it’s important to remember the historical context: since the late 1960’s, 85% of election years have seen positive equity market performance. 12 years positive, 2 years negative. What’s more, the positive years saw median performance of more than 16% for equities.

S&P Performance in Election Years

Quite often, years of strong performance (like 2023) also see an encore. Of the 11 years since 1980 that saw stronger performance than 2023, the subsequent year’s performance averaged a gain of 8%. Moreover, for years in which markets make a new high (quite possibly the case this year), markets have been positive nearly 93% of the time one year from that new high, with a median return of 14% during that year period.

Finally, following the turmoil of 2022, and alongside higher risk-free rates, investors have poured into money market funds / cash equivalents. If rates do come down, there is substantial dry powder capital that could be seeking a new home in equities.

Reasons to be Bearish

On the bearish side, current valuations and expectations, as already touched on, pose a challenge. With valuations sitting at over 19x forward earnings, the typical 1 and 5-year out market performance is around 5% per year. And earnings estimates are generally overly optimistic one year out (see 2023, for example). If earnings come in lower than the 12% estimated growth, valuations appear even more stretched, portending even lower forward returns.

Investor sentiment, as evidenced by the growing talk of a soft landing, has also gotten somewhat over-extended. Bullish sentiment among investors is now sitting at the highest levels since mid-2021. This, however, contrasts with current investor positioning: equity exposure is still well below its peak in late 2021.

Lastly, In the event rates stay flat or move higher, money market funds / bonds will continue to be competition for equities. The past decade of lower rates pushed investors out on the risk curve, forcing them to embrace more risk in equities to get any meaningful return. This is no longer the case. If longer dated bonds see even higher interest rates, investors may decrease their equity holdings to lock in long term, low risk returns. This could occur if inflation is sticker or moves higher – not a high probability, but not out of the question.

PORTFOLIO CONSTRUCTION

As we enter an exciting 2024, we want to share our thoughts on each asset class and key investment themes which will play a pivotal role in shaping our portfolios.

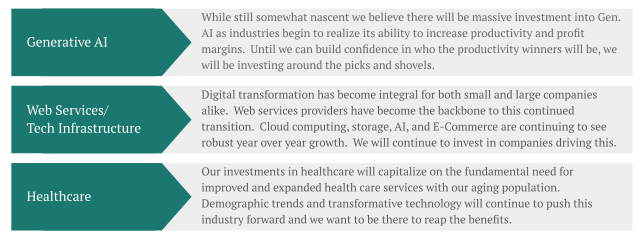

Equities

While we tend to hold a diverse basket of equities to ensure proper risk management, when we feel the time is right, we will make bigger bets on certain investment themes and industry trends. Below are the current trends we are invested in and/or around, and will continue to invest in as we see fit throughout the year.

Current Equity Investment Themes

Bonds

With the Federal Reserve raising rates over the past two years, bonds have become a much more compelling investment vehicle. With risk free rates at 5%+, investors are no longer forced to embrace high risk just to eke out a reasonable return. We will continue to take advantage of our ability to generate these risk free returns when there is concern of equity volatility ahead. As of now we have the majority of our bond position sitting on the short end of the curve in government T-Bills (<1 year), seeking to minimize duration risk in the event that inflation sparks up again.

If and when we begin to see recession on the horizon, you will see us de-risk from equities and begin to move into bonds further out on the curve (10-20 year bonds). As of now we do not hold any investment grade nor junk bonds, but may look for an entry if given the opportunity. This opportunity would likely only arise if rates stay high and corporations have trouble rolling their debt over the next few years. This would likely lead to a credit event, which could open up an interesting opportunity for entry.

Alternatives

Currently our smallest asset allocation, these alternatives are becoming increasingly attractive as equity valuations continue to climb higher. Our ability to grow your capital in an uncorrelated manner will be critical in years with high equity volatility. In a choppy, flat or down equity market, it is our belief that these alternatives will meaningfully outperform.

CLOSING THOUGHTS

We enter the year cautiously optimistic on both the economy and financial markets but understand the potential volatility ahead. With much of the equity upside potentially squeezed out already in anticipation of Fed easing and alongside a more resilient consumer, even a continued soft landing may not deliver a substantial return in equities. High yields available in short term bonds and alternatives remain appealing as the end of the Fed’s hiking campaign plays out. Given that the end of tightening cycles generally result in harder rather than softer landings (it’s tough to stop a trend on a dime), it remains prudent to be nimble while also seeking uncorrelated sources of return.