IN REVIEW: 2024 Q2

The second quarter of 2024 presented a more complex economic landscape, challenging some of the optimism that characterized the start of the year. While the S&P 500 managed a strong gain of over 4% for the quarter, this performance masked underlying tensions in the market and economy.

ECONOMICS

The “stronger for longer” theme that persisted through 2023 and early 2024 has downshifted into a “growing but slowing” environment. 2024 Q1 GDP growth officially came in at 1.4%, a marked slowdown from the 3.4% growth at the end of 2023. And Q2 appears to be on track for a similar level. Indeed, estimates for GDP growth in 2024 as a whole peaked around March, and have been trickling down ever since.

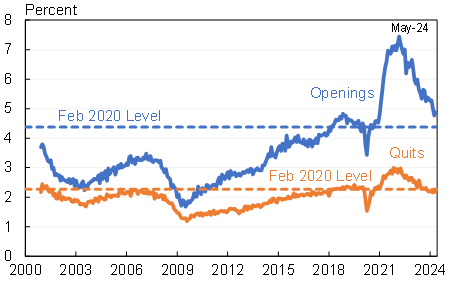

Labor markets, while still relatively strong, have begun to show signs of softening. The unemployment rate ticked up to 4.1%, and continuing jobless claims have been trending upward. Job openings per unemployed worker are nearly down to pre-covid 2020 levels, while quit rates have already dipped below those levels. This cooling in the job market has started to impact consumer spending, which is forecast to see its contribution to Q2 GDP growth nearly halve compared to Q1.

Job Openings & Quits Rate

Source: BLS, Jason Furman

Inflation, the thorn in the side of policymakers, remained stubbornly elevated. Core PCE, the Fed’s preferred inflation gauge, has stabilized around 3%, still above the central bank’s 2% target. However, the higher-than-expected inflationary pressures of Q1 seem to have deteriorated somewhat, with more recent readings showing further relief. Absent further economic weakness, though, it doesn’t seem that inflation will be able to reach the Fed’s target.

FINANCIAL MARKETS

In the equity market, the narrative of concentrated returns in mega-cap tech stocks persisted. NVDA, MSFT and AAPL battled back and forth for the title of world’s largest company. Markets were propelled in part by rising S&P 500 earnings estimates, which have continued to tick up after already starting the year with double-digit growth expectations. However, this forecast appears somewhat at odds with the moderating economic backdrop.

Bonds continued to struggle, as stubborn inflation readings and a Fed still unable to cut rates weighed on investors. The yield curve remained inverted, with the 10-year Treasury yield hovering around 4.3% by quarter’s end. Investment-grade corporate bonds have seen spreads widen slightly, reflecting growing concerns about credit quality in a higher-for-longer rate environment.

Commodities were neutral to down generally during the quarter alongside a weakening economic picture.

FEDERAL RESERVE

While the softening of the labor market and consumer was somewhat welcome news to the Fed, the persistence in inflationary pressures has forced the Fed to maintain its restrictive stance. The Fed’s most recent forecasts indicate just a single rate cut expected for 2024. Investors, however, still have two cuts priced in for the year, in part a function of the recently weak month-over-month readings on inflation.

The Fed continues to be in a difficult spot. Their preference would be to begin to cut rates and ease financial conditions before the economic weakness builds too high – this deterioration has historically snowballed into recessions. On the positive side, a weaker economic picture should help the more recent moderation in inflation persist. Indeed, inflation tends to be among the more lagging of indicators. If there is more disinflation in the pipeline, investors would likely cheer the start of Fed rate cuts.

CURRENT CONDITIONS

As we note above, we notice an economic shift towards the “growing but slowing” environment. This phase alleviates some pressure from inflation but raises concerns about sustaining long-term momentum in growth, jobs and credit.

WHAT’S AHEAD

The resilience of the U.S. economy is being tested by stubborn inflation and tighter financial conditions. The coming months may well bring increased volatility as investors recalibrate their expectations in light of this evolving economic reality. And this is all against the backdrop of the coming election, with conditions – including potentially candidates – shifting rapidly.

Economic growth is expected to continue its gradual deceleration, with consensus forecasts now projecting full-year GDP growth around 2.4%. This moderation, while still indicative of expansion, suggests a cooling economy that may struggle to meet the double-digit earnings expectations currently priced into the stock market. Falling expectations, should they occur, tend to bode poorly for market performance.

The labor market, still relatively robust, is finally showing signs of softening. This trend and its impact on consumer spending bears close watching – personal consumption is far and away the largest contributor to economic growth. Any significant weakening in employment could accelerate the economic slowdown and potentially force the Fed’s hand on rate cuts.

For now, however, the conditions remain somewhat “goldilocks” in nature for equities – still just enough growth with inflation that, while not ideal, is still largely being managed in the right direction. Consumers and corporations maintain healthy balance sheets, with historically low levels of debt-service to income ratios. The resolution of uncertainties around the election should be supportive of markets through the end of the year. And any preemptive Fed cuts to stabilize a “slowing but growing” economy will likely be cheered by investors. If we continue to bend and not break, markets will likely continue their path higher.

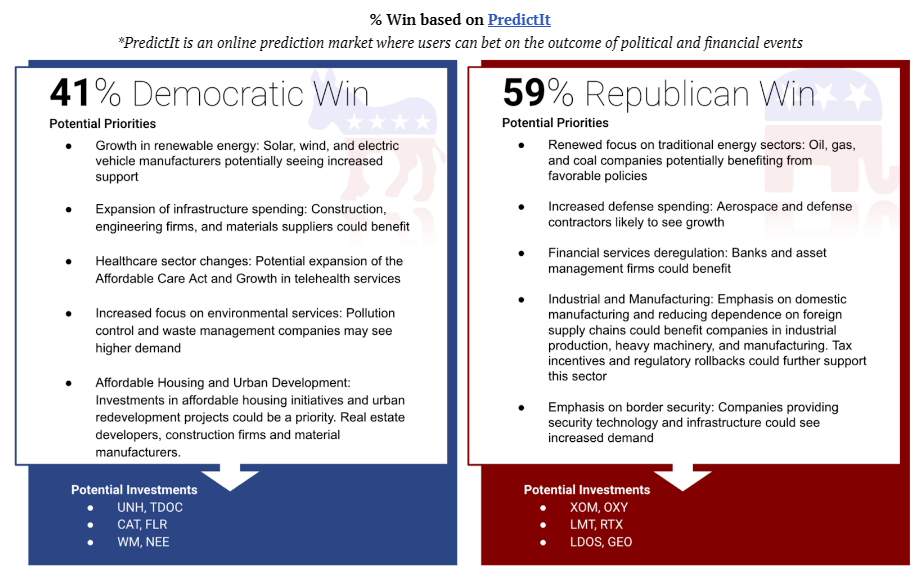

ELECTION IMPACT

Deep down, we all want the same things – good health, good quality of life and time spent with family and friends. Unfortunately, partisan bickering and sensationalism can serve to distract from underlying Democratic vs Republican priorities. As we approach the upcoming presidential election, we want to highlight how different outcomes might impact various sectors and industries of the economy. As discussed, outsized deficit spending likely from both sides of the aisle has important implications for different sectors, industries, and our portfolios.

It’s worth noting that some sectors, such as technology and consumer staples, may be less directly impacted by the election outcome and more influenced by broader economic trends. We are aware that campaign promises don’t always translate directly into policy, and the ability to implement changes often depends on the composition of Congress. As always, we will adjust for the uncertainties of political and economic shifts.

REASONS TO BE BULLISH

Election year: We continue to reaffirm the belief that election years are bullish for equity markets. As we noted in our last newsletter, both Biden and Trump, in our view, are populist candidates. They want to appease voters with tax cuts, subsidies, loan forgiveness and other “stealth” stimulus that boosts consumer confidence, spending and ultimately asset prices.

Fiscal Policy: Nothing stops this train. As long as the government continues to run deficits this large, it is hard to see a negative outlook for U.S. equities. This aggressive fiscal policy, targeting key sectors like manufacturing, defense, healthcare, and agriculture, is likely to inflate nominal GDP, continuing to boost equities and real estate.

Global Economic Recovery: As major economies like China show signs of stabilization/growth, this could provide tailwinds for U.S. multinational corporations and global trade, supporting earnings growth.

Rate Cuts: As inflation continues to dissipate, some investors may wonder whether the Fed could really cut with stocks at all-time highs. The answer is yes – they’ve done it 20 times since 1980 and the S&P was higher a year later all 20 times. Bulls will be putting their faith in history while bears might argue we’ll only see this magnitude of cuts if something is “broken” – it remains to be seen whether it’ll be the former or the latter.

REASONS TO BE BEARISH

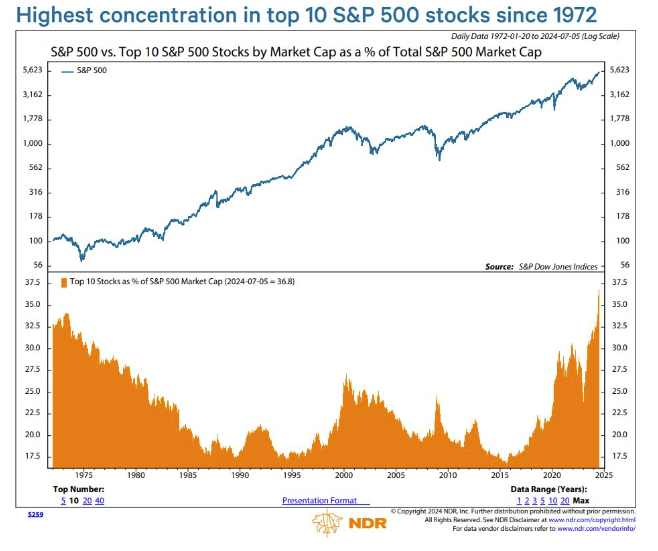

Concentration: With nearly 37% of the S&P 500 index in just 10 stocks, there is a high concentration risk. Any negative events affecting these companies could have an outsized impact on the overall market. The graph below shows that concentration levels fluctuate over time. High concentration periods are often followed by periods of underperformance or market corrections.

Earnings Expectations vs. Reality: Current earnings growth projections for the S&P 500 may be overly optimistic given the moderating economic growth. Any significant earnings misses / declining expectations could lead to market corrections.

Credit Market Risks: Rising delinquencies in consumer loans and potential stress in the commercial real estate sector could signal broader economic vulnerabilities. Any significant deterioration in credit markets could spill over into the broader economy and equity markets.

Geopolitical Tensions: Ongoing conflicts and trade tensions continue to pose risks to global economic stability. Escalations in these areas could disrupt supply chains, impact energy prices, and increase market volatility.

PORTFOLIO HIGHLIGHTS

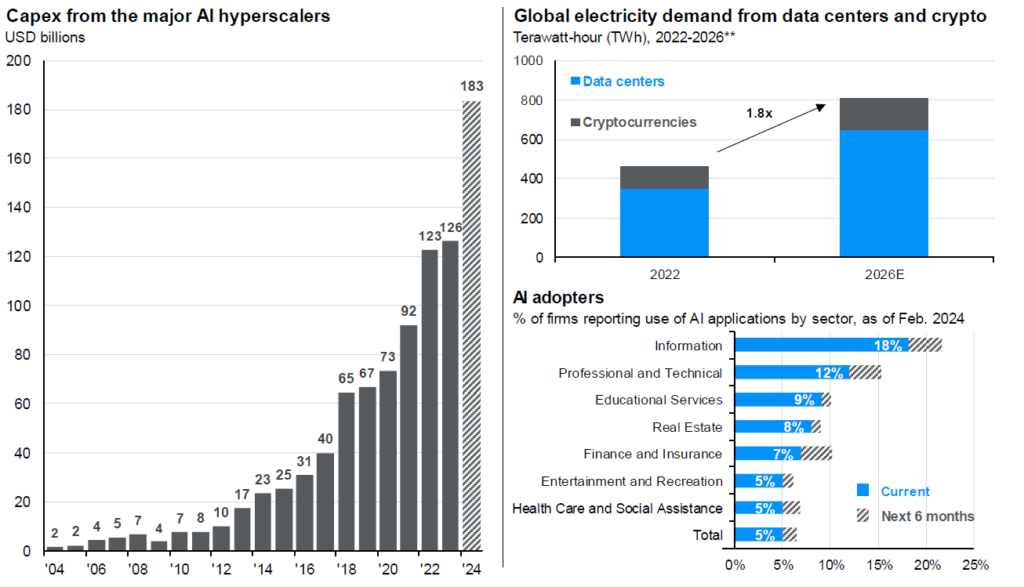

Some of our favored market segments, including artificial intelligence and healthcare innovation, continued to shine in the second quarter. On the AI front, mega-cap technology companies continue to invest heavily in AI. However, overall AI application use still remains relatively nascent. Technology companies lead the pack at 18% of firms currently reporting AI implementation. Broadly speaking, however, a mere 5% of firms in the US overall report using AI applications, leaving room for significant upside. On the power generation front, global electricity demand appears set to double from 2022-2026, largely as a result of data center power usage in connection with AI. Companies like NVDA may well continue to benefit from the expansion of AI, as may the adjacent power generation, data center and related players.

AI Investment & Adoption

Source: JPMorgan

Within healthcare, companies like LLY continue to push the boundaries in exciting areas like weight-loss innovation. LLY is already the market leader with the Mounjaro – a substance that targets two weight-loss promoting hormones in the body over Ozempic’s single hormone. And yet, LLY is in trials for a triple-threat drug that targets three separate weight-loss promoting hormones. Early results show weight loss in participants of nearly 25% over a 1-year period, besting the 22% of existing Mounjaro. With a massive potential market, this innovation should benefit companies like LLY for some time.

CLOSING THOUGHTS

We remain cautiously optimistic for the remainder of 2024, with moderated growth and persistent inflation presenting challenges. Equity markets may continue to climb the “wall of worry” despite risks from concentrated mega-cap stocks, presenting opportunities in overlooked sectors.

The fixed income market remains challenging, with yields still elevated and the yield curve inverted. While we continue to like short-duration bonds for their attractive yields, longer-dated bonds still face headwinds from inflation uncertainty and potential shifts in Fed policy.

Alternative investments continue to play a crucial role in our portfolios, offering diversification, absolute returns and potential downside protection in an environment of heightened uncertainty.

As we move closer to the U.S. presidential election, we’re mindful of the potential for increased market volatility. However, historical data suggests that markets often perform well in election years, with potential for further gains post-election regardless of the outcome.

Our strategy moving forward remains adaptable. Should we see a material deterioration in economic indicators or a significant escalation in geopolitical tensions we will adjust accordingly. Conversely, any sustained improvement in the inflation outlook or signs of a continued “soft landing” for the economy could prompt us to incrementally increase equity exposure, particularly in areas that have not seen much participation. Our focus will be on preserving gains while seeking opportunities for growth.