As the expansion continues I often have friends and family who are hesitant to put new money to work. Even today, as we hit new all time highs, most of them sitting on cash are waiting for a 10-20% drop to “get in”. When I ask why, many of them say ‘because it has to’ or ‘because it has been 10 years’ but no real evidence to support their theories. Hypothesizing on what will cause the end of our current expansion is constantly discussed so today I want to focus on one key aspect which could keep it going longer than most think.

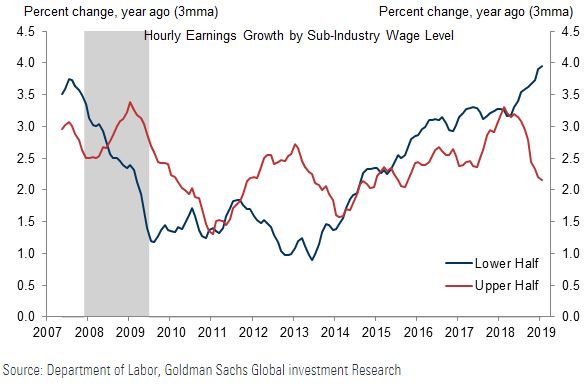

For the first time since this economic recovery began in 2009, the bottom half of earners are reaping the benefits significantly more than the top half. Now what do I mean by this. Since we have been able to sustain low unemployment for quite some time labor markets are extremely tight. This allows lower income workers to benefit through higher pay and more workable hours. Since 2018 we have seen an acceleration in wage growth for lower earners while higher earners are seeing a notable decline. Take a look at the below chart to see the large divergence beginning in 2018.

How does this help the expansion continue? To be put simply, Consumption. A strong consumption outlook for both low and high earners combined with continued growth in overall wages, in my opinion, can really keep this bad boy going. Some would argue that higher wages may begin to eat at corporate profits but it could take years for this to actually come to fruition. Philipp Carlsson-Szlezak, chief U.S. economist at AB Bernstein, shared his thoughts on the potential impact to corporate profits and stated “While pressure on capital share is likely to remain, that doesn’t mean that profits are going to fall – in fact profits can lose share at a rate up to about 100bps per year [1 percentage point] and still expect to have positive profit growth,”.

While there are many theories to why the expansion may end I wanted to share the evidence with you today on just one way we could keep this going longer than many thought. As always I want to hear your thoughts so let me know how you think this economic cycle could boom or bust.

Bonus: For those wondering why they have not seen much narrative around this go read Derek Thompson’s article on why neither Democrats nor Republicans care to acknowledge.

Hey Dane, thanks for sharing. What early indicators are you watching that might suggest the expansion is slowing down?